- Diversified UA

- Posts

- The Budget Reallocation Framework

The Budget Reallocation Framework

When to Move Money From What's Working to What's Next

Meta CPMs hit $25.22 last November. A 42% spike from January.

If you didn't have a reallocation trigger ready before that happened, you overpaid for every install that month.

And you're not alone. iOS remarketing spending surged 71% YoY (per AppsFlyer). Remarketing's share of total app spend jumped from 25% to 29% in a single year. The smart money is already moving — not to a new shiny channel, but to a system for deciding when and where to move.

$78 billion was spent on mobile UA in 2025. Most of it went to the same three channels it's gone to for years. Most teams move budget based on panic or gut feeling.

Here's a better system.

---

Two Ways Teams Reallocate Budget (Both Wrong)

Method 1: Panic Mode

Channel performance tanks. CPIs spike. ROAS craters. Someone in the Monday standup says "we need to move budget."

By the time you react, you've already burned 2-3 weeks of budget at bad rates. And the channel you scramble to? You're testing it under pressure, without proper setup.

Panic reallocation is expensive reallocation.

Method 2: Gut Feeling

"TikTok feels hot right now." "I heard CTV is the next big thing." "Let's move 20% to influencers."

No testing period. No baseline metrics. No kill criteria.

This is conviction disguised as strategy. Sometimes it works. Usually it doesn't. And you can't tell which one it is until you've spent the money.

---

The Budget Reallocation Framework

Four stages. Each one answers a different question.

Stage 1: Signal Detection

The question: Is this channel declining, or just having a bad week?

This is the #1 mistake. Treating noise as signal. One bad week on Meta and suddenly half the budget is moving to TikTok.

Use the 3-Week Rule:

- Week 1 of declining performance → Note it. Don't react.

- Week 2 of declining performance → Investigate. Is it creative fatigue? Audience saturation? A platform algorithm change?

- Week 3 of declining performance → It's a signal. Start reallocation planning.

Signal vs. Noise:

A CPI spike during Black Friday? Noise. CPIs rising three consecutive weeks with no seasonal explanation? Signal.

ROAS dipping after a creative refresh? Noise. ROAS declining while your creative quality stayed the same? Signal.

The 3-Week Rule doesn't slow you down. It prevents you from making expensive moves based on incomplete data.

Stage 2: Testing Allocation

The question: How much should you risk on unproven channels?

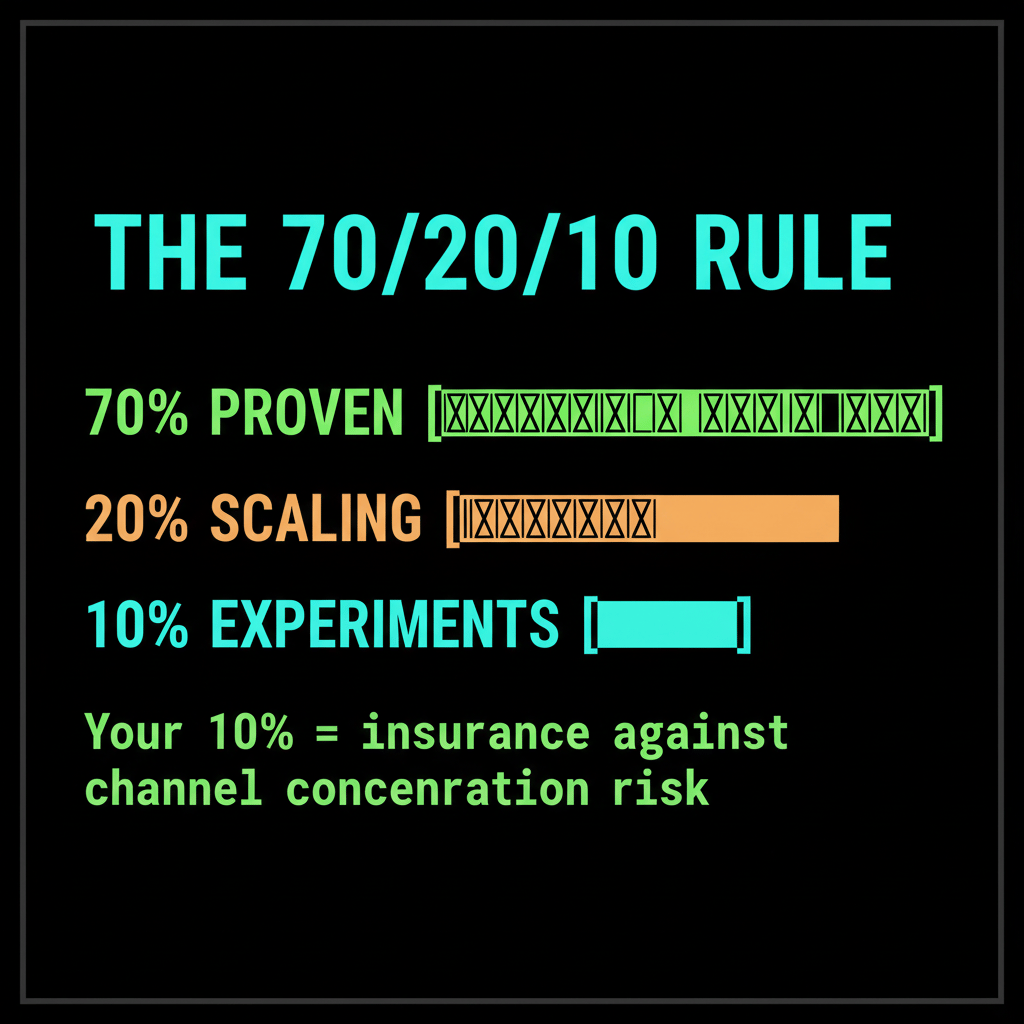

The 70/20/10 Rule:

- 70% to proven performers — channels with 3+ months of positive ROAS data

- 20% to scaling candidates — channels showing early promise, still validating

- 10% to pure experiments — new channels, new formats, no data yet

That 10% is critical. It's your insurance against channel concentration risk.

If every dollar is in "proven" channels, you have zero optionality when those channels get more expensive (and they always do).

Two principles that save money: Never test with less than $1K/week (below that, you can't distinguish signal from noise). And test one variable at a time — new channel with proven creative, or new creative on a proven channel. Never both simultaneously.

Stage 3: Scaling Threshold

The question: When does a test channel earn real budget?

A lot of teams get stuck in perpetual testing. "We're still testing TikTok" — for six months.

A test channel earns scale budget when ALL three criteria are met:

1. Repeatable performance — Positive ROAS in 3 out of 4 test weeks. Not just one lucky cohort.

2. Scalable volume — Can absorb 2x current spend without CPI degrading more than 15%.

3. Operational readiness — Your team can manage it without heroic effort. Creative pipeline, reporting, optimization cadence — all sustainable.

If a channel hits all three, promote it. Move it from the 10% experimental tier to the 20% scaling tier. Then validate at that level before it joins the 70%.

If it can't hit all three after 6 weeks of testing, kill it. Redirect to the next experiment.

Stage 4: Sunsetting

The question: When do you actually kill a channel?

This is the hardest stage. Not because the criteria are complex — but because budget reallocation is political.

The person who built your Facebook program doesn't want to see it sunset. The team that spent six months ramping TikTok doesn't want to hear "kill it." That's why you need the criteria agreed on before you need them — so the conversation is about data, not blame.

A channel enters sunset planning when ANY of these are true:

- CPI has increased 40%+ over 6 months with no recovery

- ROAS is below breakeven for 4+ consecutive weeks

- The channel delivers less than 5% of total installs at premium cost

- Platform policy or audience changes make your category unviable

Important: Sunsetting doesn't mean zero.

Reduce to maintenance budget — enough to retain learnings, pixels, and audience data. Reallocate the freed budget to your Stage 2 testing pool.

And keep monitoring. Channels cycle. What's declining today may recover in 6 months when competition shifts or the platform adjusts its algorithm.

---

What This Looks Like In Practice

A gaming app spending $200K/month across Meta, Google UAC, and TikTok. Meta CPIs have been climbing for three weeks — up 22% with no seasonal explanation. The 3-Week Rule says: it's a signal.

They check their split: 85% in Meta and Google (proven), 15% in TikTok (still scaling), 0% in experiments. That's an 85/15/0 split — way off from 70/20/10.

They move $20K from Meta into two experiments: $10K into CTV (new paid channel) and $10K into content investment for AI visibility (based on the audit from Issue #50). They keep Meta running but at reduced spend while testing whether the CPI trend reverses.

Four weeks later: Meta CPIs stabilize at the higher level (new normal). CTV shows promise — positive ROAS in 3 of 4 weeks. AI visibility isn't measurable yet but content is being indexed.

They promote CTV to the scaling tier. Redirect another $15K from Meta. Their new split: 72/18/10. Closer to the framework. And they have optionality they didn't have before.

---

Putting It Together

Here's what a monthly budget review looks like with this framework:

Step 1: List every active channel and its 4-week trend.

| Channel | CPI Trend | ROAS Trend | % of Budget | Current Tier | Action |

Channel | CPI Trend | ROAS Trend | % of Budget | Current Tier | Action |

|---|---|---|---|---|---|

Meta | ↑ 22% | ↓ declining | 55% | Proven | Review: sunset criteria? |

Google UAC | → stable | → stable | 30% | Proven | Maintain |

TikTok | ↓ improving | ↑ improving | 10% | Scaling | Scale candidate |

CTV | new | new | 3% | Experiment | Test (Week 2 |

AI Visibility | n/a | n/a | 2% | Experiment | Content investment |

Step 2: Apply the 3-Week Rule. Which channels are showing genuine decline signals?Step 3: Check your current split against 70/20/10. Are you over-concentrated in "proven" channels? Is your experimental budget actually being spent?

Step 4: For any channel in decline, check the sunset criteria. If it triggers, start planning the shift.

Step 5: Document decisions in a one-page reallocation brief your team can reference. Share it. Make the criteria visible so the next review is a conversation about data, not politics.

Do this monthly. Not quarterly. Channels move fast. Your budget should move with them.

---

The AI Visibility Question

Now run your 10% experimental allocation through the Stage 2 lens.

Is AI visibility in there?

In Issue #50, I covered how 62% of consumers now use AI assistants to research apps — and how AI recommends only 1.2% of brands. Most teams allocate nothing to this channel.

AI visibility isn't paid media (yet). It's a content investment. But it competes for the same budget pool.

The framework doesn't tell you to invest in AI visibility. It tells you to ask the question: given the data from Issue #50, should it at least be a candidate in your 10% experimental tier?

If the answer is no, you should have a reason. If you don't have a reason, it probably belongs there.

---

One Thing To Do This Week

Pull up your channel allocation. Calculate what percentage sits in channels where CPIs have risen 15%+ in the last 3 months.

That's your reallocation pool.

Now pick one channel from that pool. Apply the sunset criteria from Stage 4. And make a call by Friday: reduce, maintain, or kill.

One channel. One decision. This week.

---

Daniel Avshalom

P.S. — If you missed the last two issues on AI visibility, start with Issue #50: The AI Visibility Blind Spot. It covers why 98.8% of brands are invisible to AI recommendations — and what the 1.2% are doing differently.